As water and sewer utilities, the public health and safety of our customers is our priority – it is both a legal and moral responsibility. The economic stability and growth of our community depends on reliable services or high quality. The priority is not the same with private business. Private businesses have a fiduciary responsibility to their stockholders, so cutting services will always be preferred to cutting profits. Therein lies the difference and yet the approach is different. Many corporations retain reserves for stability and investment and to protect profits. Many governments retain inadequate reserves which compromises their ability to be stable and protect the public health and safety. Unlike corporations, for government and utilities, expenses are more difficult to change without impacting services that someone is using or expects to use or endangering public health. Our recent economic backdrop indicates that we cannot assume income will increase so we need to reconsider options in dealing with income (revenue) fluctuations. If there are no reserves, when times are lean or economic disruptions occur (and they do regularly), finding funds to make up the difference is a problem. The credit market for governments is not nearly as “easy” to access as it is for people in part because the exposure is much greater. If they can borrow, the rates may be high, meaning greater costs to repay. Reserves are one option, but reserves are a one-time expense and cannot be repeated indefinitely. So if your reserves are not very large, the subsequent years require either raising taxes/rates or cutting costs. An example of the problem is illustrated in Figure 1. In this example the revenues took a big hit in 2009 as a result of the downturn in the economy. Note it has yet to fully return to prior levels as in many utilities. This system had accumulated $5.2 million in reserves form 2000-2008, but has a $5.5 million deficit there after. Reserves only go so far. Eventually the revenues will need to be raised, but the rate shock is far less if you have prudently planned with reserves. You don’t get elected raising rates, but you have a moral responsibility to do so to insure system stability and protection of the public health. So home much is enough for healthy reserves? That is a far more difficult question. In the past 1.5 months of operating reserves was a minimum, and 3 or more months was more common. However, the 2008-2011 economic times should change the model significantly. Many local governments and utilities saw significant revenue drops. Property tax decreases of 50% were not uncommon. It might take 5 to 10 years for those property values to rebound so a ten year need might be required. Sales taxes dropped 30 percent, but those typically bounce back more quickly - 3-5 years. Water and sewer utilities saw decreases of 10-30%, or perhaps more in some tourist destinations. Those revenues may take 3-5 years to rebound as well. Moving money from the utility to the general fund, hampers the situation further. Analysis of the situation, while utility (government) specific, indicates that appropriate reserves to help weather the economic downturns could be years as opposed to months. The conclusion is that governments and utilities should follow the model of trying to stabilize their expenses. Collect reserves. Use them in lean times. Develop a tool to determine the appropriate amounts. Educate local decision-makers and the public. Develop a financial plan that accounts for uncertainty and extreme events that might impact their long-term stability. Take advantage of opportunities and most of all be ready for next time. In other words, plan for that rainy day.

infrastructure

Surpluses?

It was not so long ago that we were talking about local and state governments suffering major shortfalls in their revenues as a result of the downturn in the economy. Cuts were being made to police, fire, education and parks. Politicians were fussing over the need to cut taxes and cut government expenditures in the process. Employees lost jobs and benefits were cut. In a prior blog we discussed the fact that economic upticks and downturns were cyclical, and unlike people, there is a tendency for local and state government policy makers to “hang with the curve” so to speak and have government expenses track the economy as opposed to try to stabilize spending by taking advantage of the ups to create reserves in order to take advantage of the downs. They ignore the old adage that their grandparents told them – save for a rainy day. And we don’t recognize those rainy days approaching! It is not a lot different unfortunately than many citizens who spend when they have money, and are short when they don’t. We are not a country of savers and it hurts us often.

There is however a major benefit for government to have reserves. When government has reserves, it can take advantage of lower competition to construct or invest in infrastructure in lean times. There are many examples of governments getting construction done at discounted rates based on timing their projects to economic downturns. A side benefit is that those governments are spending money at the time when they need to keep people employed. FDR did this during the Great Depression. Obama attempted to copy him in 2009 with the AARA monies. In both cases they may not have invested enough, but both were faced with deficits on the federal level and a Congress that was reluctant to spend.

The economy has rebounded and state and local governments are starting to run surpluses. The South Florida Sun-Sentinel recently reported that the big “challenge” for the Florida Legislature and many other state and local governments, is they are running surpluses. Recall the last time the federal government ran a surplus, we got tax cuts that immediately put the feds back in the red because they had not built up any reserves, and won’t even with a balanced budget anytime soon. Well Florida has $1.3 billion extra on hand and guess what we hear in this election year – tax cuts, more money for special projects, extended sales tax exemption dates, etc. Those running for office are thrilled with the surplus because it helps their platform but we hear nothing about restocking the trust funds that were raided during the 2009, 2010 and to some extent the 2011 budgets!

Expect this to be the norm, and the rhetoric should be troubling to fiscally responsible people. If we have surpluses, times must be better. In good times we should be encouraging decision-makers to sock money away in reserves, savings and other solid investments, and at the same time restocking those accounts drained to pay the bills during the down time of the Great Recession. In Florida, our highway trust fund, environmental trust funds and education funds were drained. They have not been restocked. In fact the cuts to most of those programs has not been restored either. The next economic downturn will come – will we be prepared to weather storm by spending our savings as opposed to cutting services which magnifies the impact of residents?

As times get better, utilities owned by local governments should pay particular attention to General Fund revenues. Many of those General Funds increased contributions from the water and sewer funds to make up the difference in losses of property and sales tax dollars. That prevented utilities from making investments, or forced them to borrow money to cover investments that might otherwise have been paid for in cash. Time for the General Fund to pay the utility back! Time to restock the reserves and time to spend money to catch-up with the deferred maintenance and capital. Of course the costs are not what they were 3 or 4 years ago, and neither are the interest rates, so we all pay more for the same projects because we could not spend the reserves in the down period.

Utilities should always have significant reserves. Nothing we do is inexpensive, so having reserves makes it possible to fix things that inevitably go wrong. Reserves are a part of a well operated, fiscally sound utility. Taking money from the utility during down times hurts both the utility and the local government. Total reserves diminish of the entity, making it less possible to deal with emergencies, cover the loss of revenues, or take advantage of lower costs for construction projects. Meanwhile, creating reserves and a pay-as-you-go system for ongoing replacement of pipes and pumps is good business. It insures that ongoing money is spent to prevent deterioration of the utility system. The reserves allow for accelerated expenditures when times are tough, prices are down and people need work. When utilities spend money, it translates to local jobs. But the only way to do this is make convincing argument of the benefits of reserves and spending.

SEA LEVEL RISE AND FLOOD PROTECTION

Regardless of the causes, southeast Florida, with a population of 5.6 million (one-third of the State’s population), is among the most vulnerable areas in the world for climate change due its coastal proximity and low elevation (OECD, 2008; Murley et al. 2008), so assessing sea level rise (SLR) scenarios is needed to accurately project vulnerable infrastructure (Heimlich and Bloetscher, 2011). Sea level has been rising for over 100 years in Florida (Bloetscher, 2010, 2011; IPCC, 2007). Various studies (Bindoff et al., 2007; Domingues et al., 2008; Edwards, 2007; Gregory, 2008; Vermeer and Rahmstorf, 2009; Jevrejeva, Moore and Grinsted, 2010; Heimlich, et al. 2009) indicate large uncertainty in projections of sea level rise by 2100. Gregory et al. (2012) note the last two decades, the global rate of SLR has been larger than the 20th-century time-mean, and Church et al. (2011) suggested further that the cause was increased rates of thermal expansion, glacier mass loss, and ice discharge from both ice-sheets. Gregory et al. (2012) suggested that there may also be increasing contributions to global SLR from the effects of groundwater depletion, reservoir impoundment and loss of storage capacity in surface waters due to siltation.

Why is this relevant? The City of Fort Lauderdale reported last week that $1 billion will need to be spent to deal with the effect of sea level rise in Fort Lauderdale alone. Fort Lauderdale is a coastal city with canals and ocean property, but it is not so different from much of Miami-Dade County, Hollywood, Hallandale Beach, Dania Beach and host of other coastal cities in southeast Florida. Their costs may be a harbinger of costs to these other communities. Doing a “back of the napkin” projection of Fort Lauderdale’s cost for 200,000 people to the additional million people in similar proximity to Fort Lauderdale means that $5 billion could easily be spent over the next 100 years for costal impoundments like flap gates, pumping stations, recharge wells, storm water preserves, exfiltration trenches and as discussed in this blog before, infiltration galleries. Keep in mind that would be the coastal number and we often ignore ancillary issues. At the same time, an addition $5 to 10 billion may be needed for inland flooding problems due to the rise of groundwater as a result of SLR.

The question raised in conjunction with the announcement was “is it worth it?” I suggest the answer is yes, and not just because local politicians may be willing to spend money to protect their constituents. The reality is that $178 billion of the $750 billion economy of Florida, and a quarter of its population, is in the southeast. With nearly $4 trillion property values, raising a few billion for coastal improvements over 100 years is not an insurmountable task. It is billions in local engineering and construction jobs, while only impacting taxpayers to the tune of less than 1/10 of a mill per year on property taxes. This is still not an insurmountable problem.

I think with good leadership, we can see our way. However, that leadership will need to overcome a host of potential local community conflicts as some communities will “get more” than others, yet everyone benefits across the region. New approaches to working together will need to be tried. But the problem is not insurmountable, for now…

Water = Civilization

A number of years ago I had the pleasure of speaking with archeaologist Bryan Fagan for an hour or so before a presentation he gave at a conference. Dr. Fagan is a modern-day Indiana Jones, who has been all over the world studying ancient ruins. Dr. Fagan expressed his career as “50 years of studying drainage ditches,” but with studying drainage ditches he could provide you with the rise and fall of civilizations through history. His book Elixir outlines a number of these civilizations: Egyptian, Babylonia, Southeast Asia, and even the American West. His findings were that the civilization expended as far as infrastructure could be constructed to allow water to flow to where it was needed, whether that was Alexandria or Ur. Later civilizations expanded and developed as technology allowed water to flow further. Rome demonstrated that water could be moved with more than ditches, which would have been a severe limitation for Rome and other civilizations based in dry areas with topography. The Romans constructed extensive tunnels and aqueducts to supply Rome with water from mountains to the east and north. A recent article noted that we probably know about 20% of the Roman tunnel system as we keep discovering more of it each year – tunnels lost in the Dark Ages after the fall of Rome. Dr. Fagan notes that it was access to water that allowed human civilizations to develop and evolve. It is why a number of engineering organizations like Water for People and Engineers Without Borders focus their efforts on providing access to clean water to people in Third World countries. It is their only way to get to the modern world. All other infrastructure: roads, major buildings, etc., result from the access to clean water that allows people to be healthy and productive.

So if civilization rises and falls with access to water, why is it so hard to get public officials to fund water supply and rehabilitation projects? We talk of an infrastructure crisis in the United States because our average water and sewer infrastructure systems are working on 50 years old and deterioration is evident. We have many mid-western communities with water, but no customers to pay for deteriorating infrastructure (Detroit), and southeastern utilities that have lost factories that supported the bulk of their utility, and insufficient growth in the customer base to deal with operations and maintenance. As a result, outages and breaks occur more frequently, costing more money to repair, but under the auspices of maintaining rates, the revenues do not increase to support the needed repairs.

At least the southeast has surface supplies, albeit perhaps limited, which constrains growth (Atlanta), but our fastest growth often occurs in areas we know have limited precipitation, like a lot of the American West. Yet somehow we expect groundwater sources that do not recharge locally, to sustain the community indefinitely without disruption – ignoring the fact that history tells us communities cease to function when water supplies are exhausted. USGS identified many areas that have long-term permanent declines in aquifers as a result of pumpage for agricultural and community uses. No one raises the question about the aquifer levels – permits get issued, but little data is gathered and very limited plans are available in most places to deal with the declines. And no one raises a question about aquifer levels because stopping growth to deal with water supplies is not in conformance with the desire to grow, which is required to support additional services demanded by the community.

No one questions how to secure the water either, much of which has been “created” by federal tax dollars spend over 50 years ago during the era of great dam building (1920-1960). However, as these systems and populations age, the concern about costs will continue to engender discussion. And hand wringing. Water costs money. Water creates civilization and sustains it. When we take it for granted, it becomes all too easy to fall behind the proverbial “eight-ball,” and the system crashes. It is a testament to the utility personnel – the managers, engineers and operators – that these systems continue to operate as they do. But bailing wire and duct tape only go so far. We need to develop a frank discussion about the need to infuse funds – local, federal, state and private – into addressing our infrastructure needs. The dialog needs to commence sooner, as opposed to after failure.

Groundhogs and Super Bowls

It’s groundhog day and Super Bowl Sunday! The groundhog saw his shadow indicating 6 more weeks of winter, but you wouldn’t know it at the Super Bowl. The bright lights are on in New Jersey with over 80,000 fans braving the cool, but no the harsh cold weather of last weekend. Just like the groundhog this morning, millions will be watching. The Super Bowl is biggest one day sporting event in the world with over 100 million viewers watching it live in the US, and over a billion around the world. And we all enjoy the commercials too, but it speaks to our priorities when a 30 second commercial will cost $4 million. A lot of utilities could do a lot with $4 million. Just saying….

Detroit – Feast to Famine – it there a Lesson to Learn?

I have said before in this blog that my Dad’s family were born and raised in Detroit – not the suburbs, in the City, about a mile north of Tiger Stadium. My great-grandfather was a butcher. His sons all became butchers, so my Dad grew up around the butcher shop as a kid. It was the Depression, but because of the shop, my Dad had food on his table. My Great-grandmother managed the money, and acquired a number of properties in the area of 13th and Magnolia that the sons, and extended families would eventually move to. It was a solution to the difficulties outside the shop. Family was the means to survive the hard times of the Depression.

Of course Detroit was a booming city – over 100 auto companies were in Detroit at the turn of the last century, and the City was becoming the center of a new mode of transportation – the automobile. Henry Ford developed the assembly line to allow everyone to own a car, furthering the status of the City. As the twenties developed, Detroit and Chicago competed to become the “jewel” of the Midwest. Elaborate stone buildings, expanding infrastructure for roads, trains, water, sewer and storm water were all centerpieces of pride in the City. Employment and incomes were high, worker benefits were good, the workforce was highly skilled and education was good. Profits were good and the auto industry was Detroit-centric. Detroit was a vibrant City in the first 50 years of the last century.

Scroll ahead 60 years and how the city has fallen. The City has lost a million people. It has $18 billion in debt, and is collecting $0.3 billion less in revenues since 2008. The tax base has been decimated. Houses can be purchased for minimal prices. Churches have been abandoned. Crime is high. Employment is down, unemployment remains above the state and national average. Poverty is up, incomes are down. Huge areas must be served but serve no one or only a very few. The City filed the highest profile bankruptcy for a municipality ever.

The television show Low Down Sun last summer provided a graphic look at the City – blocks of the City devoid or mostly so of housing or other buildings, schools no longer in use, roads in disrepair, classic stone buildings with the windows broken out. You can see what the City was, and the haunting view of the City today are a stark reality. To add insult to injury, the Sun-Sentinel wrote a recent article about how people are making money doing tours of abandoned buildings in Detroit, or how farming is occurring in the City limits.

So if Detroit failed, why not Cleveland, Akron, Pittsburgh, St. Louis, Cincinnati or virtually any other large, older Midwestern industrial city? Sadly many of these cities have lost the industries that made them famous and provided jobs and a stable tax base and incomes. Many of these cities are also stressed, much as we found Birmingham was. There are many arguments for what precipitated these losses: unions, shifts in population, outsourcing offshore, competition within the US, changes in consumer preferences, technology…… the list goes on. But the reality is it doesn’t matter why, the City must deal with the reality that is. We all look at Detroit and its recent bankruptcy filings. Maybe looking at Detroit allows us to feel better about our situations, but we need to learn the lesson from Detroit, Birmingham, Cleveland and others who filed for bankruptcy. We need to look back to determine where the decisions were that created the issues. Was it expanding to fast, poor economic assumptions, failure to manage finances better, political failures, failure to raise revenues/taxes/water fees, or failure to maintain or replace infrastructure? Rarely is it corruption, so it is people trying to do well but failing in their jobs. The question is why?

I would start with training. We need to train our public managers better, but MPA and MBA schools are not teaching about these failures. In part it may be because we tend to teach positive lessons, versus negative ones, but they would be useful case study of the potential challenges. In a prior blog I noted that the biggest challenge for government managers is managing in lean times. Often lean times can be overcome by saving money as fund balances and investing (well), but long-term downturns like Detroit, Cleveland and other cities have experienced cannot be corrected this way. There are major policy implications that must be overcome.

From a utility perspective it is important to note that the economic difficulties are not limited to cities and counties but utilities are subject to long-term declines as well. The problem is particularly acute in industrial communities where a large industry (think mills in the mid-Atlantic states) move away and leave water and wastewater facilities at far less capacity than they were designed for. Small systems may be especially at risk.

As an industry we need to learn from these failures. We should study the difficult times to determine how the problems can be avoided. The need to figure out how to manage funds better, deal with customer losses, and define strategies to overcome losses. If anyone has some thoughts, please respond to the blog, but doesn’t this sound like a research project in the making?

INVESTING IN INFRASTRUCTURE

When we ask what the biggest issues facing water and sewer are in the next 20 years, the number one answer is usually getting a handle on failing infrastructure. Related to infrastructure is sustainability of supplies and revenue needs. Resolving the infrastructure problem will require money, which means revenues, and overcoming the resistance to fully fund water and sewer system by local officials, the potential for significant costs or shortfalls for small, rural systems and the increasing concern about economically disadvantaged people.

The US built fantastic infrastructure systems in the mid-20th century that allowed our economy to grow and for us to be productive. But like all tools and equipment, it degrades, or wears out with time. Our economy and our way of life requires access to high quality water and waste water. So this will continue to be critical.

ASCE and USEPA have both noted the deteriorated condition of the water and wastewater systems. In the US, we used to spend 4% of the gross GNP on infrastructure. Currently is it 2%. Based on the needs and spending, there is a clear need to reconstruct system to maintain our way of life. This decrease in funding comes at a time when ASCE rates water and wastewater system condition as a D+ and estimates over $3 trillion in infrastructure investment will be needed by 2020. USEPA believes infrastructure funding for water and sewer should be increased by over $500 billion per year versus the proposed federal decrease of similar amounts or more.

Keep in mind much of what has made the US a major economic force in the middle 20th century is the same infrastructure we are using today. Clearly there is research to indicate there is greater need to invest in infrastructure while the politicians move the other way. The public, caught in the middle, hears the two sides and prefers less to pay on their bills, so sides with the politicians as opposed to the data. Make no mistake, our way of life results from extensive, highly efficient and economic infrastructure systems.

In many ways we are victims of our own success. The systems have run so well, the public takes them for granted. It is hard to make the public understand that our cities are sitting on crumbling systems that have suffered from lack of adequate funding to consistently maintain and upgrade. Public agencies are almost always reactive, as opposed to pro-active, which is why we continuously end up in defensive positions and at the lower end of the spending priorities. So we keep deferring needed maintenance. The life cycle analysis concepts used in business would help. A 20 year old truck, pump, backhoe, etc. just aren’t cost effective to operate and maintain.

Another part this problem is that people have grown used to the fact that water is abundant, cheap, and safe. Open the tap and here it comes; flush the toilet and there it goes, without a thought as to what is involved to produce, treat and distribute potable water as well as to collect, treat, and discharge wastewater.

Water and Sewer utilities are being funded at less than half the level needed to meet the 30 year demands. Meanwhile relying on the federal government, which is trying to reduce funding for infrastructure for local utilities is not a good plan either. We need education, research and demonstrations to show those that control funding of the needs. The education many be the toughest part because making the those that control funding agree to increase rates carries a potential risk to them personally. But there are no statues to those that don’t raise rates – only those with vision. We need to instill vision in our decision-makers.

Oil Energy and Utilities

Back during the dark days of the late-1970s, when America was being held hostage by Middle East oil interests, the Department of Energy was created, ostensibly to free our economy from the dependence on foreign oil and all that trappings that go with it. It was a noble goal – the American economy could grow without the risks posed by foreign governments. Thirty five years later, could we finally be reaching that goal?

Interesting the often criticized billions of energy company subsidies of the Bush era do not appear to be responsible for solving the issue. Nor are the prior efforts to subsidize or otherwise encourage investments before. The energy subsides since 2000 do not appear to be the reason, but the arctic wilderness did not need to be disturbed either. The success had nothing to do with any of it, but instead a series of private risk takers to a gamble on an unproven technology, to make great strides – fracking.

Based on the success of the development of fracking for natural gas, we have made major improvements. But it is not just fracking, as many power plants are or have been rehabilitated to convert away from oil and coal to cleaner burning natural gas, thereby developing the market for natural gas. Local governments have been migrating their fleets to natural gas for years – natural gas can use the same engine with an $8000 conversion kit that allows automobiles to run on both. The conversions have made the demand for natural gas greater, making the investments needed to frack, more profitable. The US has significant reserves of natural gas, and fracking has made it easier to capture this resource. The benefit of natural gas is that the demand for oil is down, creating a glut of oil on the market and a decrease in price (at least for now).

But the question that has been left unanswered is what the domino effect of natural gas is. Certain advertisements will argue there is 200 years of natural gas available for the US so we don’t need to worry about energy. Others will argue that only 10-15% of that supply is actually recoverable (it should be noted that this assumes current methods), which is a far shorter horizon. But in either case, natural gas in the ground is not a renewable resource so the question must be asked – does the fracking boom interfere with investment in truly renewable resources?

Since 2000, Washington has invested heavily in renewable resources – wind, solar and to an extent waves. Some energy companies like NextEra have been investing heavily in wind and solar power (they are the biggest investors in renewable power in the US), so what of these truly renewable investments? Will the rush to frack turn resources away from truly renewables? Or will renewable continue to be a small fraction of energy demands for the near future? The question remains unanswered for now.

The bigger question for utilities is whether fracking will divert money away from plans for renewable efforts like digester gas capture, solar cells and wind power at reservoirs and the like that utilities are using to help reduce power purchases. Will it impact utility efforts to become self-sufficient energy consumers like East Bay MUD? You see the economy has few favorites. Government can create favorites, by subsidizing products that would otherwise be too expensive like PV panels. The benefit of subsides can be to reduce costs of emerging technologies that may never otherwise see widespread use. Subsidizing renewables fit this mode.

Utilities should be concerned that the rush to frack pulls money away from their plans for renewable power. As the feds look to reduce their contributions to water and wastewater infrastructure, public money to energy does not appear to be decreasing. And unlike publically owned water and sewer systems, private investment in energy is increasingly available as a result of the potential profits that can be made. The diversion of funds may decrease prospects for funding water and sewer utility options, especially if interest rates begin to rise. The Federal Reserve Bank’s concern about rising interest rates was manifested earlier this year when interest rate increased, housing sales decreased immediately.

Of course the issue of fracking goes beyond the potential to disrupt monies for renewable energy. There are questions about the practice of fracking include water quality impacts, causing earthquakes, land subsidence, etc., issue that have yet to be resolved. Keep an eye out for a risk assessment that AWWA and others will be involved with to look at these risks.

Students Get Jobs, and Bring a Fresh Perspective

We get to start the new semester this week. The economy is looking up in Florida. Unemployment is down, although the job growth appears to be mostly minimum wage jobs. So it is useful to look at last semester’s graduates and see how they are doing. The good news is they are getting jobs. In fact our seniors mostly have jobs or internships and none of them are minimum wage jobs. Excellent news, but let’s look at the new graduates and the workplace.

A lot of our assumptions about the workplace will change in the 21st century. The workplace at the “office” is less necessary and younger workers are more comfortable working outside the office environment. They may be more productive than 20th century managers think they will be because of the side benefits that flex hours allow. Their entry into the workforce places four generations at work at once: Traditionalists, Baby Boomers, Gen X, and Gen Y or Millennials. The latter are the fastest growing segment of the workforce, and are already a larger percent of the workforce than Gen X or Traditionists. The Traditionalists are retiring and are expected to be under 8 % in 2015. Gen X and Gen Y will encompass about a third of the workforce going forward.

All of these groups have different perspectives. Recent studies indicate the following. Baby Boomers grew up post-WWII in a time of change and reform. Some believe they are instruments of change. They are optimistic, hard-working and motivated by position. Gen X grew up in an era of both parents working, so are resourceful and hardworking, but not as motivated by position. They are independent, and prefer to work on their own. And many are contributing to the way government operates throughout the world. They accept technology as a way to involve others. The use of online means to solicit feedback in government is particularly a Gen X phenomenon. Public participation, traditionally are arena where limited public involvement actually occurs except with highly unpopular issues.

Gen Y was born in an era when both parents worked, but in their off-time, the parents spent more focus on the kids. Think of no winners or losers in sports, but at the same time they have had unprecedented access to technology and are often well ahead of their work mates with respect to the use of tools in the workplace. But, they are resourceful and can easily overcome technology barriers in the workplace. They care about their image and the world around them. We can use that to implement change.

However, Gen Y is facing a workplace that clearly has winners as well as some skepticism about technology. While we can expect some difficulties, it is up to the Gen X and Baby Boomers to help Gen Y make the transition. They have fresh viewpoints as they have had to be creative to get ahead. Just doing things “the same old way,” doesn’t cut it. I actually find this refreshing and a positive challenge to me because I use these challenges to go back of evaluate what my thinking was (or is). We need to embrace this perspective and channel their energy and independence to solving today’s problems.

We need to help them acclimate to the business world, while understanding that their motivations are not the same as Dan Pink notes in his book “Drive.” We need new ideas and perspectives while welcoming them to the workplace. That is how we improve productivity, product new ways to work, and develop new tools. We need all of these in the utility industry as we need better ways to upgrade infrastructure and deliver our services.

There is a lot of talk about the difficulties that Gen Y is having getting jobs. They often lack experience, but how do you get experience if no one hires you. It is circular logic and we have all been there.

We need to give the kids a chance. I see a lot of potential in our graduates, nearly all of whom are Gen Y. I see many who are hard working and know how to find answers to their questions. They are far better prepared than many think. We get comments all the time about how good our students are. That is good, because the truth is, especially in the engineering and utility world, the Gen Y workforce does not understand why things were done a certain way in the past, nor why they should remain that way. I actually find this refreshing and a positive challenge to me because I use these challenges to go back of evaluate what my thinking was (or is). We need to embrace this perspective and channel their energy and independence to solving today’s problems. They offer fresh ideas – and don’t necessary understand why. That’s ok. Long-term engineering graduates will make contributions to our water, sewer and other infrastructure.

Rural Utilities Part 2

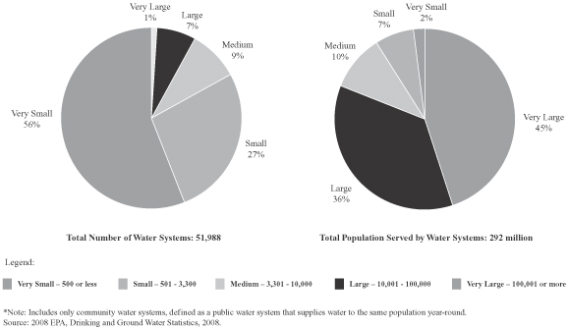

In the last blog I talked about the challenge to rural utilities, many of which serve relatively few people and have used federal monies to pay for a lot of their infrastructure. In this blog we will take a look at the trends for community water systems which are defined as systems that serve at least 15 service connections or serve an average of at least 25 people for at least 60 days a year. EPA breaks the size of systems down as follows:

- Very Small water systems serve 25-500 people

- Small water systems serve 501-3,300 people

- Medium water systems serve 3,301-10,000 people

- Large water systems serve 10,001-100,000 people

- Very Large water systems serve 100,001+ people

Now let’s take a look at the breakdown (from NRC 1997). In 1960, there were about 19,000 community water utilities in the US according to a National Research Council report published in 1997. 80% of the US population was served. in 1963 there were approximately 16,700 water systems serving communities with populations of fewer than 10,000; by 1993 this number had more than tripled—to 54,200 such systems. Approximately 1,000 new small community water systems are formed each year (EPA, 1995). In 2007 there were over 52,000 community water systems according to EPA, and by 2010 the number was 54,000. 85% of the population is served. So the growth is in those small systems with incidental increases in the total number of people served (although the full numbers are more significant).

TABLE 1 – U.S. Community Water Systems: Size Distribution and Population Served

|

|

Number of Community Systems Serving This Size Community a |

Total Number of U.S. Residents Served by Systems This Size b> |

||

|

Population Served |

1963 |

1993 |

1963 |

1993 |

|

Under 500 |

5,433 (28%) |

35,598 (62%) |

1,725,000 (1%) |

5,534,000 (2%) |

|

501-10,000 |

11,308 (59%) |

18,573 (32%) |

27,322,000 (18%) |

44,579,000 (19%) |

|

More than 10,000 |

2,495 (13%) |

3,390 (6%) |

121,555,000 (81%) |

192,566,000 (79%) |

|

Total |

19,236 |

57,561 |

150,602,000 |

242,679,000 |

|

a Percentage indicates the fraction of total U.S. community water supply systems in this category. b Percentage is relative to the total population served by community water systems, which is less than the size of the U.S. population as a whole. SOURCES: EPA, 1994; Public Health Service, 1965. |

||||

Updating these numbers, there are over 54,000 systems in the US, and growth is almost exclusively in the very small sector. 93% are considered to be small or very small systems—serving fewer than 10,000 people. Even though these small systems are numerous, they serve only a small fraction of the population. Very small systems, those that serve 3,300 people or fewer make up 84 percent of systems, yet serve 10 percent of the population. Most critical is the 30,000 new very small systems that serve only 5 million people (averaging 170 per system). In contrast, the very large systems currently serve 45% of the population. Large plus very large make it 80%. The 800 largest systems (1.6%) serve more than 56 percent of the population. 900 new systems were added, but large systems served an additional 90 million people.

What this information suggests if that the large and very large sector has the ability to raise funds to deal with infrastructure needs (as they have historically), but that there may be a significant issue for smaller, rural system that have grown up with federal funds over the past 50 years. As these system start to come to the end of their useful life, rural customers are in for a significant rate shock. Pipeline average $100 per foot to install. In and urban area with say, 60 ft lots, that is $3000/household. In rural communities, the residents may be far more spread out. As an example, a system I am familiar with in the Carolinas, a two mile loop served 100 houses. That is a $1.05 million pipeline for 100 hours or $10,500 per house. With dwindling federal funds, rural customers, who are already making 20% less than their urban counterparts, and who are used to very low rates, that generally do not account for replacement funding, will find major sticker shock.

This large number of relatively small utilities may not have the operating expertise, financial and technological capability or economies of scale to provide services or raise capital to upgrade or maintain their infrastructure. Keep in mind that small systems have less resources and less available expertise. In contrast the record of large and very large utilities, EPA reports that 3.5 percent of all U.S. community water systems violated Safe Drinking Water Act microbiological standards one or more times between October 1992 and January 1995, and 1.3 percent violated chemical standards, according to data from the U.S. Environmental Protection Agency (EPA)..

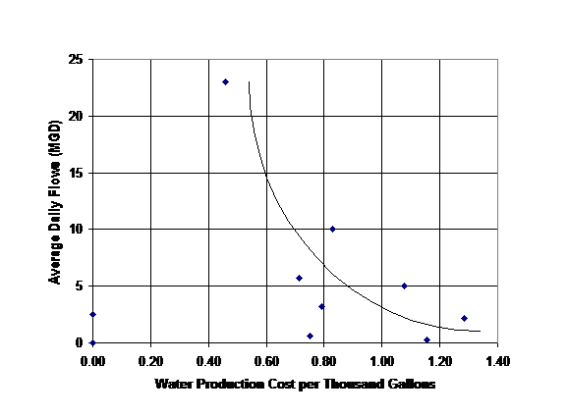

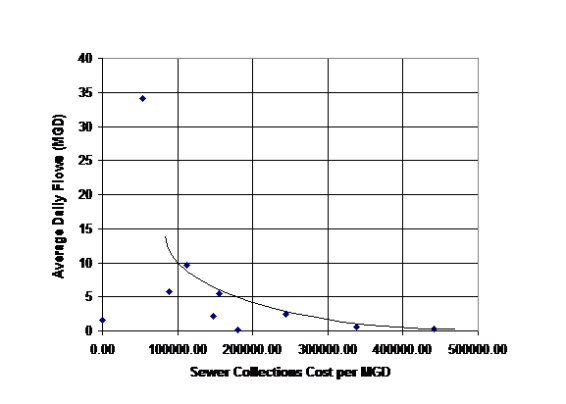

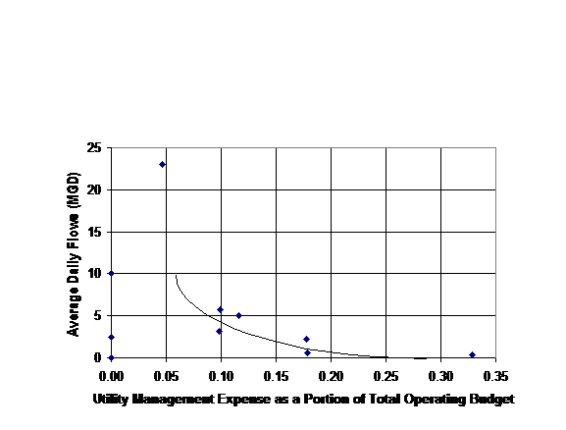

EPA and professionals have long argued that centralized infrastructure for water and sewer utilities makes sense form an economy of scale perspective. Centralized drinking water supply infrastructure in the United States consists dams, wells, treatment plants, reservoirs, tanks, pumps and 2 million miles of pipe and appurtenances. In total this infrastructure asset value is in the multi-trillion dollar range. Likewise centralized sanitation infrastructure in the U.S. consists of 1.2 million miles of sewers and 22 million manholes, along with pump stations, treatment plants and disposal solutions in 16,024 systems. It is difficult to build small reservoirs, dams, and treatment plants as they each cast far more per gallon to construct than larger systems. Likewise operations, despite the allowance to have less on-site supervision, is far less per thousand gallons for large utilities when compared to small ones. The following data shows that the economy-of-scale argument is true:

- For water treatment, water distribution, sewer collection and wastewater treatment, the graphics clearly demonstrated the economy-of-scale of the larger utility operations versus small scale operations (see Figures 2-5).

- The administrative costs as a percentage of the.total budget parameter also demonstrated the economy-of-scale argument that larger utilities can perform tasks at a lesser cost per unit than the smaller utilities (see Figure 6).

Having reviewed the operations costs, the next step was to review the existing rates. Given the economy-of-scale apparent in Figures 2 to 6, it was expected that there would be a tendency for smaller system to have higher rates. Figures 2-6 demonstrate this phenomena.

So what to do? This is the challenge. Rate hikes are the first issue, a tough sell in areas generally opposed to increases in taxes, rates and charges and who use voting to impose their desires. Consolidation is anothe5r answer, but this is on contrast to the independent nature of many rural communities. Onslow County, NC figured out this was the only way to serve people efficiently 10 years ago, but it is a rougher sell in many, more rural communities. Infrastructure banks might help, the question is who will create them and will the small system be able to afford to access them. Commercial financing will be difficult because there is simply not enough income to offset the risk. The key is to start planning now for the coming issue and realize that water is more valuable than your iPhone, internet, and cable tv. In most cases we pay more for each of them than water (see Figure 7). There is something wrong with that…

Figure 1 Breakdown of Size of Systems

Fig 2 Cost of Water Treatment

Fig 3 Cost of Water Distribution

Fig 4 Cost of Sewer Collection

Fig 5 Cost of Sewer Treatment

Fig 6 Cost of Administration as a percent of total budget

FIgure 7 Water vs other utilities