As water and sewer utilities, the public health and safety of our customers is our priority – it is both a legal and moral responsibility. The economic stability and growth of our community depends on reliable services or high quality. The priority is not the same with private business. Private businesses have a fiduciary responsibility to their stockholders, so cutting services will always be preferred to cutting profits. Therein lies the difference and yet the approach is different. Many corporations retain reserves for stability and investment and to protect profits. Many governments retain inadequate reserves which compromises their ability to be stable and protect the public health and safety. Unlike corporations, for government and utilities, expenses are more difficult to change without impacting services that someone is using or expects to use or endangering public health. Our recent economic backdrop indicates that we cannot assume income will increase so we need to reconsider options in dealing with income (revenue) fluctuations. If there are no reserves, when times are lean or economic disruptions occur (and they do regularly), finding funds to make up the difference is a problem. The credit market for governments is not nearly as “easy” to access as it is for people in part because the exposure is much greater. If they can borrow, the rates may be high, meaning greater costs to repay. Reserves are one option, but reserves are a one-time expense and cannot be repeated indefinitely. So if your reserves are not very large, the subsequent years require either raising taxes/rates or cutting costs. An example of the problem is illustrated in Figure 1. In this example the revenues took a big hit in 2009 as a result of the downturn in the economy. Note it has yet to fully return to prior levels as in many utilities. This system had accumulated $5.2 million in reserves form 2000-2008, but has a $5.5 million deficit there after. Reserves only go so far. Eventually the revenues will need to be raised, but the rate shock is far less if you have prudently planned with reserves. You don’t get elected raising rates, but you have a moral responsibility to do so to insure system stability and protection of the public health. So home much is enough for healthy reserves? That is a far more difficult question. In the past 1.5 months of operating reserves was a minimum, and 3 or more months was more common. However, the 2008-2011 economic times should change the model significantly. Many local governments and utilities saw significant revenue drops. Property tax decreases of 50% were not uncommon. It might take 5 to 10 years for those property values to rebound so a ten year need might be required. Sales taxes dropped 30 percent, but those typically bounce back more quickly - 3-5 years. Water and sewer utilities saw decreases of 10-30%, or perhaps more in some tourist destinations. Those revenues may take 3-5 years to rebound as well. Moving money from the utility to the general fund, hampers the situation further. Analysis of the situation, while utility (government) specific, indicates that appropriate reserves to help weather the economic downturns could be years as opposed to months. The conclusion is that governments and utilities should follow the model of trying to stabilize their expenses. Collect reserves. Use them in lean times. Develop a tool to determine the appropriate amounts. Educate local decision-makers and the public. Develop a financial plan that accounts for uncertainty and extreme events that might impact their long-term stability. Take advantage of opportunities and most of all be ready for next time. In other words, plan for that rainy day.

Revenues

Explaining Surpluses

My last blog was a discussion about surpluses. The State of Florida will have a $1.3 billion surplus this year and a host of politically expedient answers for where that money goes (tax cuts, pork projects, projects to help election results), but little mention of replenishing trust funds and reserves that were emptied to balance the budget amid tax cuts from 2010 – 2012. But perhaps it is not the legislators or their constituents that we should blame for not understanding the need for reserves because the truth is that most people are not used to saving. A recent article I read noted that 72 percent of Americans live paycheck to paycheck and would have difficulty putting $2000 together if needed. $2000 is not a lot of money these days – it won’t buy you a transmission for example or a new engine for your car. It won’t cover first, last and a deposit on a rental. And it won’t cover the down payment on a house or most cars. There are people who do not receive enough income to achieve some degree of savings, but not 72% of us. We have come to perceive that having little savings is normal, but it wasn’t always this way and it is not this way everywhere in the world. Back in the day, American saved more than they do now. The reason is not that they had more money (they didn’t) or that they had less to spend money on (as things cost more proportionately). But it was that “rainy day” they all knew would come and when they would need money. They had been through depressions, recession and losses of industries (remember those Concord coachmakers did not get a federal bailout in trying to compete with Henry Ford). They knew that there would be times when they needed to rely on themselves to survive and savings was the key.

There are two major differences from the past. The most important is the fact is that credit was a lot harder to come by back in the day, so you needed cash for those big purchases. That has changed dramatically in 50 years. Today we get advertisements for credit cards – in the mail, instant credit at stores, easy credit for cars, and in the early 2000s, no-money-down-no-income-verification loans on real estate. The need to save evaporated. The access to easy credit has eliminated much of the need to save for those big expenses. We can borrow to acquire them. If we have a job problem, we borrow against the house or life insurance policy. These are good backstops that help us maintain our way of life.

At the same time as we are being extended opportunities to secure funds to spend, we are barraged by advertisements and flyers and pitches to spend that money on products and services, many of which we probably don’t need, but are “cool” to have. We are encouraged to compete to have better “stuff” than the other guy, and make sure we have the newest technology. We all do it. Just look at all phones can do, while keeping in mind that the old Bell phone I bought in college still works regardless of the situation and still sounds good. No cool ringtones however, nor photo capability. All that means we spend less on “needs” and more on “stuff.”

Given this backdrop it is no surprise the attitude of decision-makers in government toward revenues and expenses. Re-education of the public is needed as opposed to rhetoric. We need to move the public discussion away from the concept of a balanced budget being expenses equal revenues to the correct concept of revenues + reserve expenses = expenses plus savings. At times you use reserves (and savings =0) while other times reserve expenses are 0, while savings are positive. When big expenses come, borrow, but recurring expenses should not be funded through borrowing (credit). We should seek to avoid is the desire to cut taxes (akin to cutting our salaries) to bring the budget back into balance that if we run a surplus, or spend it on “stuff.” Such a system leaves room for those lean times when revenues may fluctuate but expenses do not (or increase).

Surpluses?

It was not so long ago that we were talking about local and state governments suffering major shortfalls in their revenues as a result of the downturn in the economy. Cuts were being made to police, fire, education and parks. Politicians were fussing over the need to cut taxes and cut government expenditures in the process. Employees lost jobs and benefits were cut. In a prior blog we discussed the fact that economic upticks and downturns were cyclical, and unlike people, there is a tendency for local and state government policy makers to “hang with the curve” so to speak and have government expenses track the economy as opposed to try to stabilize spending by taking advantage of the ups to create reserves in order to take advantage of the downs. They ignore the old adage that their grandparents told them – save for a rainy day. And we don’t recognize those rainy days approaching! It is not a lot different unfortunately than many citizens who spend when they have money, and are short when they don’t. We are not a country of savers and it hurts us often.

There is however a major benefit for government to have reserves. When government has reserves, it can take advantage of lower competition to construct or invest in infrastructure in lean times. There are many examples of governments getting construction done at discounted rates based on timing their projects to economic downturns. A side benefit is that those governments are spending money at the time when they need to keep people employed. FDR did this during the Great Depression. Obama attempted to copy him in 2009 with the AARA monies. In both cases they may not have invested enough, but both were faced with deficits on the federal level and a Congress that was reluctant to spend.

The economy has rebounded and state and local governments are starting to run surpluses. The South Florida Sun-Sentinel recently reported that the big “challenge” for the Florida Legislature and many other state and local governments, is they are running surpluses. Recall the last time the federal government ran a surplus, we got tax cuts that immediately put the feds back in the red because they had not built up any reserves, and won’t even with a balanced budget anytime soon. Well Florida has $1.3 billion extra on hand and guess what we hear in this election year – tax cuts, more money for special projects, extended sales tax exemption dates, etc. Those running for office are thrilled with the surplus because it helps their platform but we hear nothing about restocking the trust funds that were raided during the 2009, 2010 and to some extent the 2011 budgets!

Expect this to be the norm, and the rhetoric should be troubling to fiscally responsible people. If we have surpluses, times must be better. In good times we should be encouraging decision-makers to sock money away in reserves, savings and other solid investments, and at the same time restocking those accounts drained to pay the bills during the down time of the Great Recession. In Florida, our highway trust fund, environmental trust funds and education funds were drained. They have not been restocked. In fact the cuts to most of those programs has not been restored either. The next economic downturn will come – will we be prepared to weather storm by spending our savings as opposed to cutting services which magnifies the impact of residents?

As times get better, utilities owned by local governments should pay particular attention to General Fund revenues. Many of those General Funds increased contributions from the water and sewer funds to make up the difference in losses of property and sales tax dollars. That prevented utilities from making investments, or forced them to borrow money to cover investments that might otherwise have been paid for in cash. Time for the General Fund to pay the utility back! Time to restock the reserves and time to spend money to catch-up with the deferred maintenance and capital. Of course the costs are not what they were 3 or 4 years ago, and neither are the interest rates, so we all pay more for the same projects because we could not spend the reserves in the down period.

Utilities should always have significant reserves. Nothing we do is inexpensive, so having reserves makes it possible to fix things that inevitably go wrong. Reserves are a part of a well operated, fiscally sound utility. Taking money from the utility during down times hurts both the utility and the local government. Total reserves diminish of the entity, making it less possible to deal with emergencies, cover the loss of revenues, or take advantage of lower costs for construction projects. Meanwhile, creating reserves and a pay-as-you-go system for ongoing replacement of pipes and pumps is good business. It insures that ongoing money is spent to prevent deterioration of the utility system. The reserves allow for accelerated expenditures when times are tough, prices are down and people need work. When utilities spend money, it translates to local jobs. But the only way to do this is make convincing argument of the benefits of reserves and spending.

SEA LEVEL RISE AND FLOOD PROTECTION

Regardless of the causes, southeast Florida, with a population of 5.6 million (one-third of the State’s population), is among the most vulnerable areas in the world for climate change due its coastal proximity and low elevation (OECD, 2008; Murley et al. 2008), so assessing sea level rise (SLR) scenarios is needed to accurately project vulnerable infrastructure (Heimlich and Bloetscher, 2011). Sea level has been rising for over 100 years in Florida (Bloetscher, 2010, 2011; IPCC, 2007). Various studies (Bindoff et al., 2007; Domingues et al., 2008; Edwards, 2007; Gregory, 2008; Vermeer and Rahmstorf, 2009; Jevrejeva, Moore and Grinsted, 2010; Heimlich, et al. 2009) indicate large uncertainty in projections of sea level rise by 2100. Gregory et al. (2012) note the last two decades, the global rate of SLR has been larger than the 20th-century time-mean, and Church et al. (2011) suggested further that the cause was increased rates of thermal expansion, glacier mass loss, and ice discharge from both ice-sheets. Gregory et al. (2012) suggested that there may also be increasing contributions to global SLR from the effects of groundwater depletion, reservoir impoundment and loss of storage capacity in surface waters due to siltation.

Why is this relevant? The City of Fort Lauderdale reported last week that $1 billion will need to be spent to deal with the effect of sea level rise in Fort Lauderdale alone. Fort Lauderdale is a coastal city with canals and ocean property, but it is not so different from much of Miami-Dade County, Hollywood, Hallandale Beach, Dania Beach and host of other coastal cities in southeast Florida. Their costs may be a harbinger of costs to these other communities. Doing a “back of the napkin” projection of Fort Lauderdale’s cost for 200,000 people to the additional million people in similar proximity to Fort Lauderdale means that $5 billion could easily be spent over the next 100 years for costal impoundments like flap gates, pumping stations, recharge wells, storm water preserves, exfiltration trenches and as discussed in this blog before, infiltration galleries. Keep in mind that would be the coastal number and we often ignore ancillary issues. At the same time, an addition $5 to 10 billion may be needed for inland flooding problems due to the rise of groundwater as a result of SLR.

The question raised in conjunction with the announcement was “is it worth it?” I suggest the answer is yes, and not just because local politicians may be willing to spend money to protect their constituents. The reality is that $178 billion of the $750 billion economy of Florida, and a quarter of its population, is in the southeast. With nearly $4 trillion property values, raising a few billion for coastal improvements over 100 years is not an insurmountable task. It is billions in local engineering and construction jobs, while only impacting taxpayers to the tune of less than 1/10 of a mill per year on property taxes. This is still not an insurmountable problem.

I think with good leadership, we can see our way. However, that leadership will need to overcome a host of potential local community conflicts as some communities will “get more” than others, yet everyone benefits across the region. New approaches to working together will need to be tried. But the problem is not insurmountable, for now…

Rural Utilities To Feel The Squeeze

Several weeks ago we looked at the phenomenon of population, income, education and unemployment. The impact to from the combination of these factors in certain communities can be difficult. Let’s explore a little further as there is more, interesting data every day. The US Department of Agriculture is releasing its report of rural America. The findings are interesting and counter-intuitive to the understanding of voters in many of those communities. Their findings include:

- The rural areas grew 0.5 % vs 1.6% in urban areas from mid-2011-mid 2012

- Rural incomes are 17% lower than urban incomes.

- The highest income rural works (95th percentile) earn 27% less than their urban counterparts

- 17.7% of rural constituents live in poverty vs 14.5% in urban areas

- 80% of the high poverty rate counties were rural

- All the high income counties are urban.

Wow! So the ghetto has move to the country? According to these statistics there is truth in that statement. Let’s look a little further using some on-line mapping.

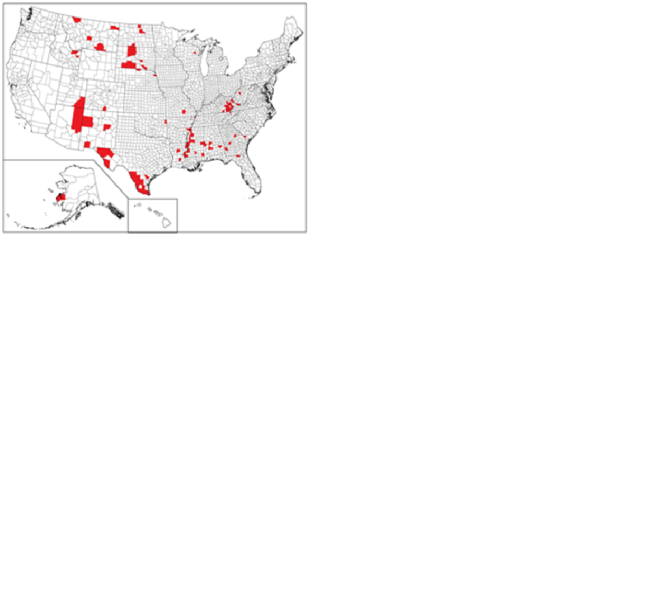

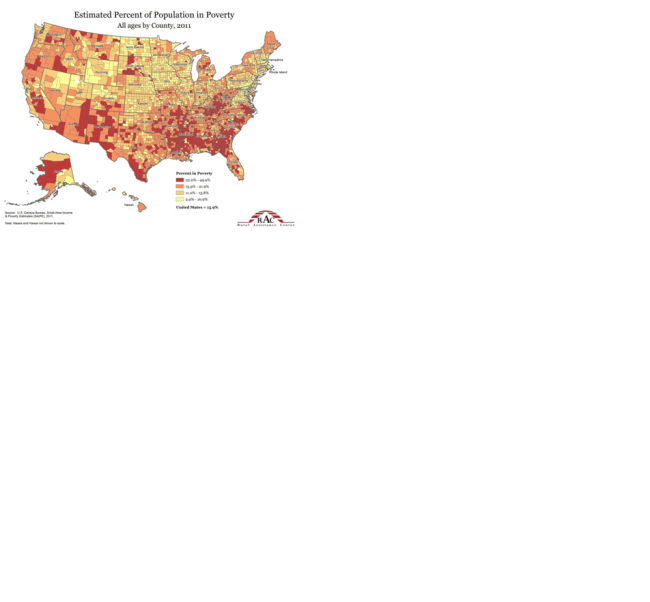

First let’s look at where these rural counties are. Figure 1 is a map from www.dailyyonder.com that shows (in green) the rural counties in the US. Wikipaedia shows the 100 lowest income counties in Figure 2. For the most part, these counties are rural, with the exceptions being a few areas in south Texas and in the Albuquerque/Santa Fe area of New Mexico. Raceonline.com shows the populations in poverty by county. The red areas are the highest poverty rates. The red areas in Figure 3 expand Figure 2 to include much of the rural deep south, Appalachia, more of Texas and New Mexico and part of the central valley in California.

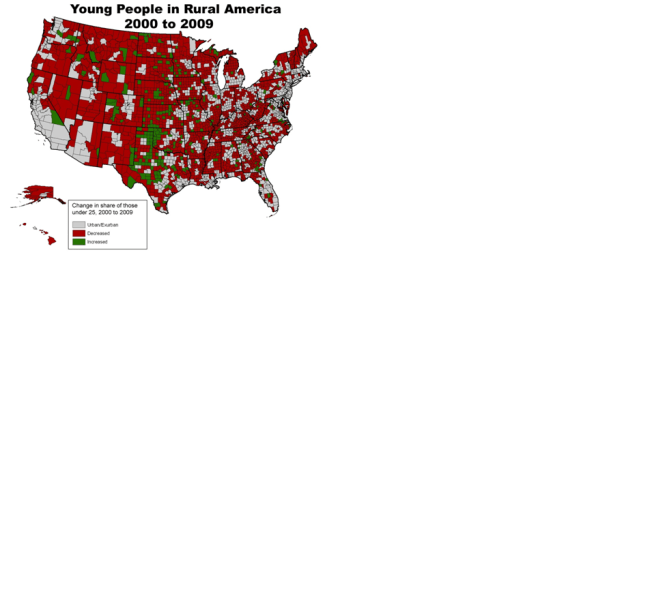

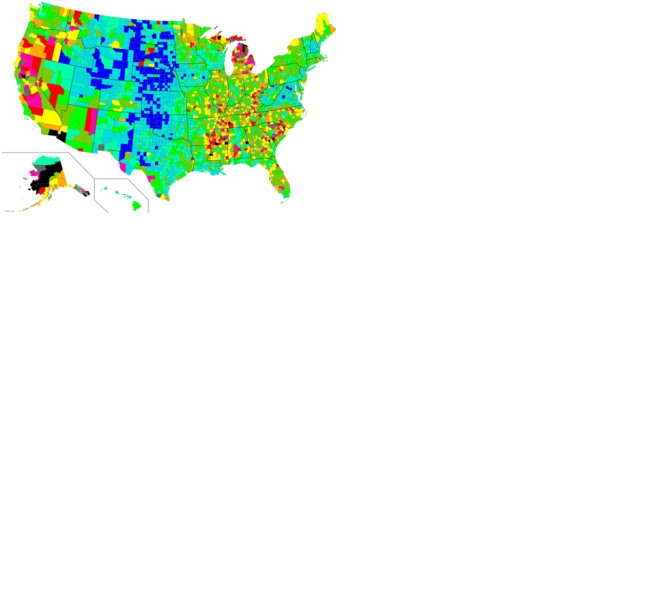

Figure 4 shows how the number of young people has changed between 2000 and 2009 in rural counties (urban counties are white and not included – red means a decrease). Figure 5 shows population growth (or not) by county. What you see in these two maps is that the young people are moving to the rocky mountain states and vacating the high poverty counties in Figure 3. Yong people do not see jobs in the rural area – unemployment is 20% higher in rural America and the jobs that are there pay less. Figures 6 and 7 show unemployment by County in 2008 after the start of the Great Recession and in 2013. What these figures show is that with exception of the Plains states and Rockies, is that many of the areas with high poverty also had high unemployment, and that the unemployment has remains stubbornly high in many rural areas in the Deep South, Appalachia and New Mexico, plus high unemployment in parts to the Great Lakes, but the poverty rates are still lower. Education may by a factor in why the Plains states and Rocky Mountains have less unemployment – despite being rural their students are far more likely to graduate from high school than those in the deep South, Appalachia where unemployment remains high and incomes low.

So what does this possibly have to do with utilities? Utilities need to understand this problem as is demands some real, on-the-ground leadership. Small and rural utilities are more costly to operate per thousand gallons than larger utilities. A 1997 study by the author showed that economy-of-scale manifested itself to a great extent with water and wastewater operations. The differences were not close – it is a lot less costly to operate large utilities vs small ones. Rural utilities complicate the issue further because not only is the number of customers limited, but the pipe per customer is less so the capital investment per customer is far higher than in urban areas. The impact is that utilities are under pressure to reduce rates to customers, or create a set of lower cost rates for those in poverty, while at the same time their costs are increasing and infrastructure demands are incrementally higher than their larger neighbors. The scenario cannot be sustained, especially when large portions of rural infrastructure was installed with FHA grants, meaning the customers never paid for the capital cost in the first place. There was no or lower debt, than what larger utility customers have. The rural rates since these investments have been set artificially lower than they should as a result. But with Congress talking about reducing SRF and FHA programs, FHA is unlikely to step in to replace their initial investment, meaning that the billions of rural investment dollars that will be needed in the coming years will need to be locally derived, and rate shock will become a major source of controversy in areas that are largely very conservative politically and tend to vote against projects that will increase costs to them.

The good news is that much of the rural infrastructure may be newer when compared to much of the urban infrastructure. So there is time to build the argument that local investment is needed. The community needs to be engaged in this discussion sooner as opposed to when problems occur. Saving for the infrastructure may be the best course since rural utilities will have limited access to the borrowing market because of their size, but that means raising rates now and keeping those saved funds as opposed to using them to deer rate increases. If ongoing efforts in the House deplete federal funding further, the pinch will be felt sooner by rural customers who will lose the federal dollars from SRF and FHA programs.

Figures 1 – Rural Counties

Figure 2. 100 lowest income Counties in the US

http://en.wikipedia.org/wiki/List_of_lowest-income_counties_in_the_United_States

Figure 3. Estimated population in poverty

http://www.raconline.org/racmaps/mapfiles/poverty.jpg

Figure 4. Where the Young People Are

http://www.raconline.org/maps/topic_details.php?topic=55

Figure 5. Where people are moving to http://www.raconline.org/maps

Figure 6 Unemployment 2008

http://en.wikipedia.org/wiki/Unemployment

Figure 7 Unemployment 2013 http://www.huduser.org/portal/pdredge/pdr_edge_featd_article_040

SRF Wars in Congress – What it Means to Utilities

As 2014 is only a month away, expect water and sewer infrastructure to become a major issue in Congress. While Congress has failed to pass budgets on-time for many years, already there are discussions about the fate of federal share of SRF funds. The President has recommended reduction in SRF funds of $472 million, although there is discussion of an infrastructure fund, while the House has recommended a 70% cut to the SRF program. Clearly the House sees infrastructure funding as either unimportant (unlikely) or a local issue (more likely). Past budgets have allocated over $1.4 billion, while the states put up a 20% match to the federal share. A large cut in federal funds will reverberate through to local utilities, because many small and medium size utilities depend on SRF programs because they lack access to the bond market. In addition, a delay in the budget passage due to Congressional wrangling affects the timing of SRF funds for states and utilities, potentially delaying infrastructure investments.

This decrease in funding comes at a time when ASCE rates water and wastewater system condition as a D+ and estimates over $3 trillion in infrastructure investment will be needed by 2020. USEPA notes that the condition of water and wastewater systems have reached a rehabilitation and replacement stage and that infrastructure funding for water and sewer should be increased by over $500 billion per year versus a decrease of similar amounts or more. Case Equipment and author Dan McNichol have created a program titled “Dire Straits: the Drive to Revive America’s Ailing Infrastructure” to educate local officials and the public about the issue with deteriorating infrastructure. Keep in mind much of what has made the US a major economic force in the middle 20th century is the same infrastructure we are using today. Clearly there is technical momentum to indicate there is greater need to invest in infrastructure while the politicians move the other way. The public, caught in the middle, hears the two sides and prefers less to pay on their bills, so sides with the politicians as opposed to the data.

Local utilities need to join the fray as their ability to continue to provide high quality service. We need to educate our customers on the condition of infrastructure serving them. For example, the water main in front of my house is a 50 year old asbestos concrete pipe that has broken twice in the past 18 months. The neighborhood has suffered 5 of these breaks in the past 2 months, and the City Commission has delayed replacement of these lines for the last three years fearing reprisals from the public. Oh and the road in front of my house is caving in next to where the leak was. But little “marketing” by the City has occurred to show the public the problem. It is no surprise then that the public does not recognize the concern until service is interrupted. So far no plans to reinitiate the replacement in front of my house. The Commission is too worried about rates.

Water and sewer utilities have been run like a business in most local governments for years They are set up as enterprise funds and people pay for what they use. Just like the private sector. Where the process breaks down is when the price is limited while needs and expenses rise. Utilities are relatively fixed in their operating costs and I have yet to find a utility with a host of excess: workers. They simply do not operate in this manner. Utilities need to engage the public in the infrastructure condition discourse, show them the problems, identify the funding needs, and gain public support to operate as any enterprise would – cover your costs and insure you keep the equipment (and pipes) maintained, replacing them when they are worn out. Public health and our local economies depend on our service. Keep in mind this may become critical quickly given the House commentary. For years the federal and state governments have suggested future funding may not be forthcoming at some point and that all infrastructure funding should be local. That will be a major increase in local budgets, so if we are to raise the funds, we need to solicit ratepayer support. Now!

WHY ARE HEALTH CARE COSTS SO HIGH?

Why are health care costs increasing so fast? Did you ever wonder about that? We keep hearing about how health care costs, Medicare, Medicare, Obamacare are going to bankrupt us, but why is that? Why are the cots going up so fast? It is an important challenge for local officials and utilities who generally pay the health insurance costs for their workers. There is more to the story that we are not being told.

One problem that get identified quickly is that only 80% of the population is included in the health care system. Many who are not are “healthy” young people who don’t demand the services. The concept of the health care bill was to solve this problem by spreading the costs of health care across the entire population using private and public providers. First, I think there are way more unhealthy people included in the 20% than we realize because the political dialogue keeps focusing on the few that want to live off the grid – I feel great so I don’t need insurance. That guy is part of the problem. That guy gets into a car accident, gets taken to a public hospital, gets treated, gets a bill for $26,000 to fix his broken leg, refuses to pay anything, and the taxpayers get stuck with the bill. My solution to that guy is if you don’t want to pay for health insurance, bring cash. Otherwise, “no soup for you!” to paraphrase a famous Seinfeld episode. Of course my doctor, nurse and therapy friends think that’s a little cold hearted.

The next argument is the cost of doctors, therapists and nurses. Okay, I know a bunch of them, and that’s not where the money goes. These people have lost money in the past 10 years. Many are going form full-time to part-time employments as Medicare, Medicaid and health insurance bureaucrats decide services are no longer needed. They will tell you the major change in their lives is paperwork….hold that thought for a moment.

The cost of drugs comes up. Medicare and Medicare are the largest purchasers of pharmaceuticals in the world. So in other works, they set the lowest price by supposedly bidding the “contracts” for services. Only there is often only one provider, so exactly how does that work? Sounds like we don’t get a good deal there, which is why the arguments for importing Canadian drugs or drugs from Mexico keeps popping up. They get a better deal than we do and most of these are supposedly AMERICAN companies. No home town discount (I guess I know where free agent baseball players get the idea). And my medical friends confirm this as an issue. Check out the comments from Mr. Falloon at Life Extension (www.lef.org) for discussion.

So let’s go back to the paperwork discussion. Once upon a time doctors simply sent a little paperwork to the health insurance company or the federal government and said you needed some service. And the insurance company processed the bill for the services. The cost was paid by insurance premiums collected by the insurance company. Everyone was happy. But then someone at an insurance company said, “wait we could make more money if we asked more questions and paid less for these services. It would help our bottom line.” So you hear the complaint that the folks at the insurance companies are deciding whether you need that procedure or not. And contractors decide if someone needs Medicare or Medicaid services, not the government, not your doctor, your nurse or your therapist. Not any person that knows you, but some unseen, private sector bureaucrat who’s goal is to minimize the amount of your premium spent on services so they can enhance their bottom line. And apparently they are very effective because the health insurance industry is very lucrative. So maybe we have stumbled onto something here. Maybe the cost of medical coverage is more related to drugs and bureaucracy (and it is not government bureaucracy!!) than the actual cost of services. Maybe the old system, even if there was some fraud in it, wasn’t nearly as bad as it was made out to be. It reminds me of one of the 4 laws of City management I developed years ago: Never give elected officials a bad alternative – it becomes a magnet. It always worked (hence a law). I didn’t learn why until years later when I realized, that the worst option was the one all the lobbyists lobbied for even at the local level. It was the option where they could make the most money “fixing

LOCAL REVENUES BLEAK? Part 1

A new GAO report suggests that the short and long-term future for state and local revenues may be more difficult that currently anticipated, despite the economy recovering in many places. For most of the 1990s and the mid 2000s, many states and local governments operated with surpluses, or could have. Many elected officials, like those in Florida (or Congress in 2001), chose to reduce tax rates to balance the budget as opposed to restocking reserve funds. When property values plummented and tourism and consumer buying diminished, the taxes related to all three plummented as well. None have yet returned to their pre-2008 levels. In fact, the property values lag so badly, it may be 10-20 years in many jurisdictions before they return to their former selves. In South Florida’s suddenly “hot” real estate market, local officials are raving about the 28% increase in property values in 2012/2013. Sounds great until you realize that they need to increase 100% to return to pre-2008 levels. Even in a hot market it may be over 5 years to recover. So property values are not a short-term problem. Some communities may never recover. So much for saving for that rainy day.

It should be plain to all of us that the failure of those in power to stockpile reserves caused many governments to spend down what limited reserves they had in the past 5 years as a means to avoid the hard and unpopular decision – raising taxes to collect the same revenues as before the mid-2000s cuts. Now the lack of reserves creates an issue going forward – as costs increase faster than revenues, there are no reserves to tap into. It is a problem that just keeps on giving. The failure to address the root cause – the failure to set revenues collections at an appropriate level and accumulate surpluses when you are lucky enough to get them. Unfortunately the political discussion keeps going back to keeping costs down, but cuts in costs means cuts in services. Sounds great to cut the Plantation trolley because of budget needs, but what about those citizens that rely on the trolley? Or the businesses it serves. Cutting Meals on Wheels which primarily serves shut-ins is a great idea in Broward County with a hue population of elderly that find it difficult to get out of the condo? And does it really make much impact on the overall budget? Not really. There are cosmetic issues. There a more symptomatic issue here?

GAO points to health care as a cost increasing faster than the rate of increase in revenues, but the latest data seems to indicate that the rate of growth may be less than projected by those opposed to the new Health Care laws. Underfunded pensions are also a potential area of concern, but cutting employees is not the solution for that as outlined in a prior blog. Cutting employees cuts the funding for pensions which guarantees future problems. So that idea actually works against the goal of shoring up the problem. So, no that is not the answer. We are clearly paying for the sins of 15 years ago when we were awash with funds, but decided to cut or public “income.” Who does that anyway?!?!

I never like Chicken Little, because he never had a solution for the problem. Part 2 will outline some thoughts…

Increase Revenues without Raising Rates

It surprises me how many utilities ignore their meter stock. Water meters are the “cash registers” of the utility – they are how we bill our customers. Many utilities allow their meters to age without checking how much loss their may be. I have a client who regularly has issues with high unaccounted for water, which is a permit condition. Every time the issue arises, they ask me what to do. Each time I ask the Finance Department, which is responsible to for meter reading and billing, to check the number of meters with 90 days of zero readings. The past two times I had them do this the number of meters was about 10% of the system! Both times I have had them replace all 10% immediately. The result each time was to decrease the unaccounted for water amount in half (15 to 7%). In essence they received a 7% rate increase without raising rates. Yet, the Finance department NEVER runs the zero read report unless I ask them to.

This situation is all too common. Meters lose accuracy with time. Small meters lose accuracy slower than big meters, which may lose 50% of their accuracy (for low flows) within 2 years, but the small meters may not last the 15 to 20 years they are typically installed. The easy way to monitor this is to run a zero read report monthly, and to run a report to compare the water billed 12 months apart to see if the billing amount decreases significantly from year to year. Water utilities need regular meter maintenance to insure they are receiving the revenues for services delivered. But it is often too easy, or too politically difficult to spend the dollars to insure meters run accurately and to bill people appropriately. But we should ask if it is fair to bill others disproportionately to avoid fixing the meter problem?

Similarly utilities need to insure that everyone is being billed. Some cities do not charge themselves for water, which means they cannot track it adequately. Other potential users that are not metered or charged include churches, parks, and schools. There is a fairness issues associated with not billing everyone. Likewise, large losses that cannot be accounted for may be indicative of water theft. A water audit program can help identify potential water theft. Theft is an affront to all customers.

Utilities should also look at fees for services. Sometimes these have not been adjusted for years. Utilities should determine exactly what it costs to provide services like meter turn-ons, turn-offs and call outs. A couple utility clients of mine have contracted to perform services for other utilities as a mean to raise revenues without big rate increases.

Keep in mind though that rates need to increase because power, chemicals and capital needs are constantly increasing. Power, cable, telephone and other utilities increase to insure they recoup their costs. Water and sewer utilities should incorporate CPI-type increases in their rate structures to insure they can sustain ongoing operations and capital replacement programs. Insuring everyone is billed properly and the meter inventory is up-to-date insures that rate increases are limited to what is actually needed.